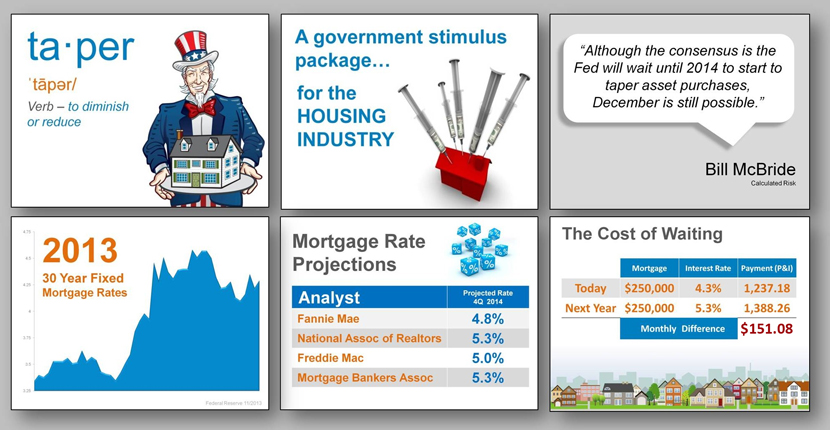

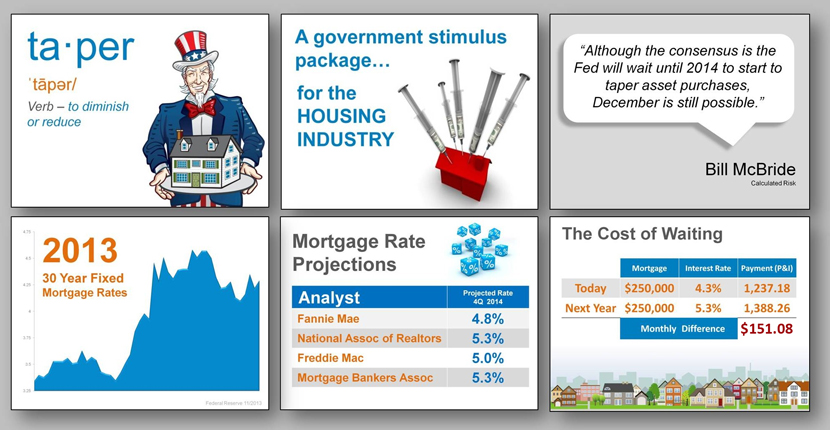

The Fed announced they would be pulling back some of their stimulus package which has helped the housing market by keeping long term mortgage rates at historic lows for the last few years. This should come as no surprise as the KCM Blog has been warning of this likelihood over the last several months.

We even went against the belief of the vast majority of economists who thought the Fed would wait until next year. In this month’s edition of KCM, we quoted Bill McBride ofCalculated Risk:

“Although the consensus is the Fed will wait until 2014 to start to taper asset purchases, December is still possible.”

We also gave our members the following grouping of slides to help them explain the ramifications of the Fed’s decision during meetings with buyers and sellers.

What it Means to the Consumer

In an article in MarketWatch today, Lawrence Yun, the Chief Economist at NAR, explained that sellers looking to move-up (to a better school district or larger home) “need to realize that it could be more challenging a year from now.” Yun stated the average 30-year mortgage rate currently hovers at 4.3%, but that could rise to 5% or 5.5% next year.

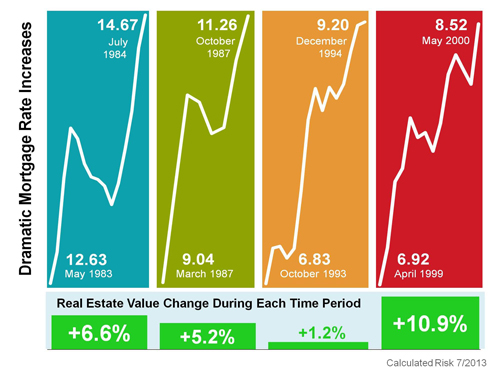

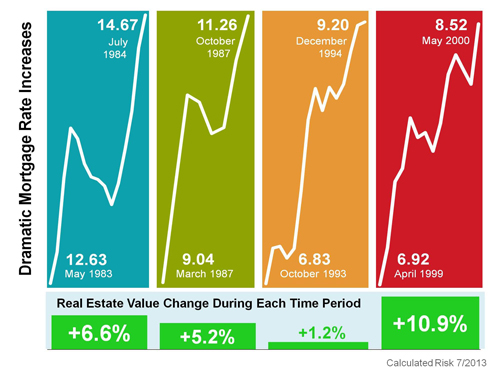

What it Does NOT Mean to the Housing Market

Some reports will now claim that housing prices will have to drop as interest rates begin to rise. There is no historical evidence of this. Below is a chart showing the last four instances of mortgage rates rising dramatically and what happened to home values at the time.

Bottom Line

If a client is either a first time buyer or a move-up buyer, they should make the move earlier in 2014 instead of later as mortgage rates will probably increase as the year goes on.

Approximately 5.6 million property owners in over 20,000 communities across the country rely on the National Flood Insurance Program (NFIP) for flood insurance. A new law, the Biggert-Waters Flood InsuranceReform Act of 2012, will force major changes in the NFIP. Despite efforts by some on Capitol Hill to delay the act, it looks set to take effect. According to an article in Insurance Journal last week,FEMA Administrator Craig Fugate said:

“There are challenges to implementing the law when premiums may exceed $10,000 in more high-risk areas where homes are not easily elevated or bought out.”

How many will be affected?

The Insurance Journal article also explained:

“Last year’s legislation promises premium increases to 1.1 million homeowners who’ve received subsidized, below-risk coverage and could sock even more homeowners whose homes met older building standards or were deemed at lower risk under previous flood maps. Under the old rules, they could retain their old rates since they followed the rules when they bought or built their homes, but they will soon lose those grandfathered rates under the new law.”

Could it impact home sales in the regions impacted?

Again, we refer to the Insurance Journal article:

“The changes also promise to make it unaffordable for people in chronic flood zones to keep their homes, and they have put a damper on home sales in areas where benefits extended to current homeowners can’t be passed along to prospective buyers.”

What can be done to delay the changes?

Write your Member of Congress and Senators. Congress has legislation in the House, H.R. 3370 and Senate, S. 1610, to delay changes to the NFIP.

According to the National Association of Realtors, these bills would:

- prudently defer rate increases until FEMA completes the affordability study mandated by law

- create a system for targeted rate relief

- establish an office of the Advocate for flood insurance rate and mapping concerns.

Week of November 11th. 2013

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists,real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

The latest survey was released last week. Here are the results:

- Home values will appreciate by 4.3% in 2014.

- The average annual appreciation will be 4.2% over the next 5 years

- The cumulative appreciation will be 28% by 2018.

- Even the experts making up the most bearish quartile of the survey still are projecting a cumulative appreciation of over 16.8% by 2018.

Individual opinions make headlines. We believe the survey is a fairer depiction of future values.